Investing in tangible assets is a timeless strategy, with gemstones like diamonds, rubies, sapphires, and emeralds being some of the most enticing options. This article dives into the investment potential of these dazzling stones, weighing their tangibility, liquidity, and risk factors.

Tangibility: The Everlasting Appeal

Gemstones, with their immortal beauty and unaffected value from volatile markets or financial crises, make for tangible assets. Your diamonds, rubies, sapphires, and emeralds are safe, secure, and ready to dazzle or deal as you wish.

Size and Quality: The Defining Factors

When considering investment-grade gemstones, size plays a vital role. Diamonds and colored stones below 1 carat aren’t seen as investment pieces, but rather beautiful elements of jewelry. Their investment viability is enhanced if they’re scarce, historically significant, or tied to celebrity lore.

Gemstones generally offer a larger profit margin for dealers than gold, meaning an immediate resale could lead to a loss for the buyer. However, the value of some gemstones appreciates over time, providing a potential investment opportunity. Here, we focus solely on natural gemstones, given the minimal resale value of synthetic or lab-grown counterparts.

Diamonds: A Clear Cut Investment?

Diamonds, celebrated for their liquidity and concentrated wealth, are a favored investment option. While both white and fancy colored diamonds offer potential, investing in them demands careful consideration of the 4Cs—cut, clarity, color, and carat—along with certification to avoid lab-grown or treated stones.

Despite the diamond market’s fluctuating nature, certain diamonds, like vivid fancy colored variants (yellow, pink, blue), appreciate faster than white diamonds, making them potentially better investments.

Unraveling the Mystique of Rubies, Sapphires, and Emeralds

The value of these gemstones is often dictated by their color. Pigeon’s blood rubies, deep blue sapphires, and rich green emeralds with slight blue undertones command the highest prices. Geographic origin also significantly impacts their value—Myanmar rubies, Kashmir or Sri Lankan sapphires, and Colombian emeralds are particularly coveted.

Given the prevalence of treatments and synthetic stones in the market, these gemstones require certification from a reputable lab and proper provenance documentation. While slightly less liquid than diamonds, these colored stones can appreciate substantially over time due to the scarcity of high-quality sources.

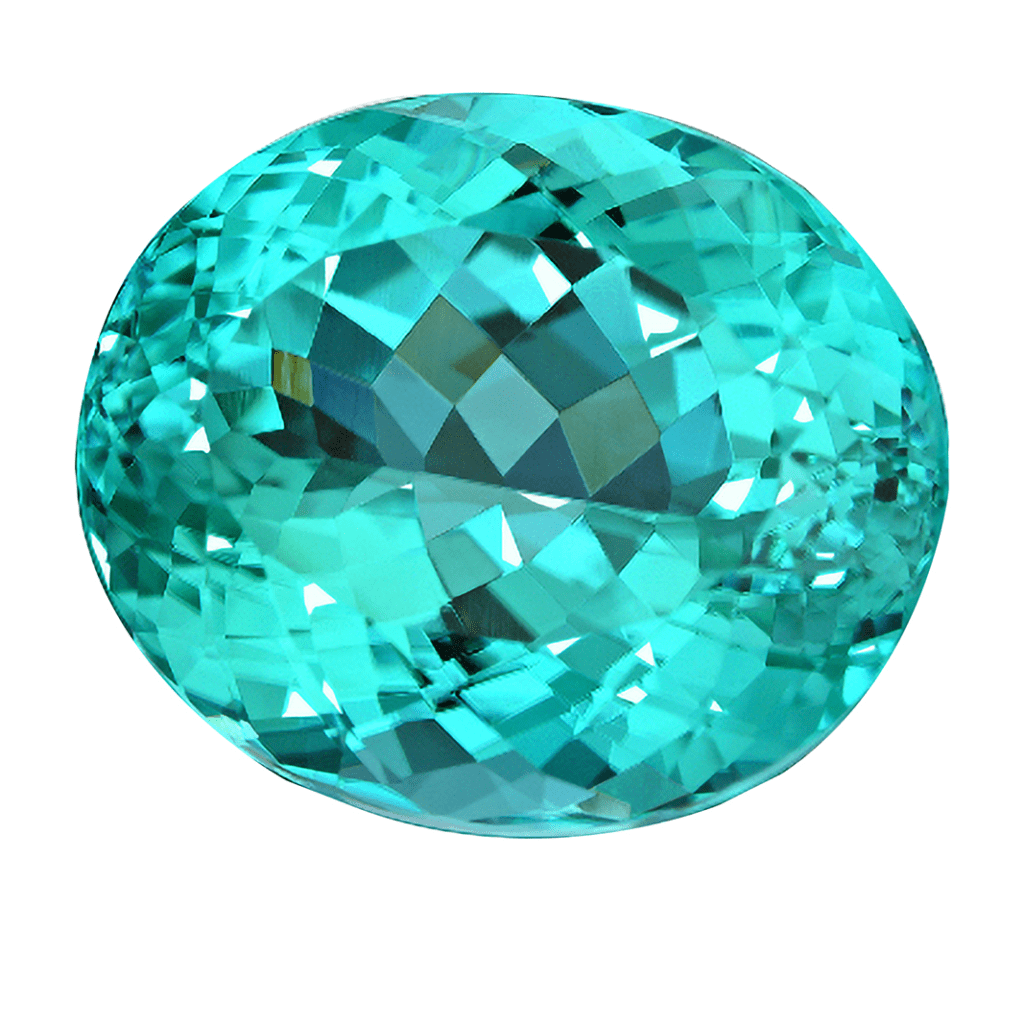

A Look at Semi-Precious Stones

Rare semi-precious stones like paraiba, alexandrite, and imperial topaz carry a high price tag and are relatively scarce. However, due to limited market understanding among jewelers, these can be difficult to liquidate.

Common semi-precious stones like amethyst, peridot, blue topaz, and citrine are abundantly available and stable in price. Though beautiful, their low cost limits their investment potential.

Navigating the Million-Dollar Question: Where to Invest? An Opinion

Gemstones, with their tangibility, potential appreciation, and shield against economic instabilities, present a compelling investment proposition. As part of a diversified strategy, allocating 10% to 20% of your net worth to gemstones or jewelry could be wise. This way, you’re not only investing but also adding splendid pieces to your personal collection.

How should you distribute this allocation? Given their liquidity and often predictable market, I’d recommend placing half in investment-grade fancy colored diamonds, which appreciate faster than white diamonds. The remaining half could go towards the vibrant and potentially lucrative rubies, sapphires, and emeralds.

In summary, diamonds and colored stones such as rubies, sapphires, and emeralds each carry their own unique advantages. Beyond their potential financial rewards, they are tangible assets that you can appreciate and enjoy for their sheer beauty.